By: Giuseppe Racanelli, Royston Menezes and James Villines

Published: June 04, 2024 | Updated: June 06, 2024

Read time: 10 minutes

- Table of contents

Introduction

Small businesses drive the US economy. They number more than 33 million and employ 46.4% of the private workforce, according to a Federal Reserve Banks (FRB) survey. They also create 1.5 million jobs annually and represent 64% of new jobs, according to the US Small Business Administration.

The capacity of small and medium-sized businesses (SMBs) for job creation underscores their importance in economic vitality. Yet despite their economic contribution, small-business owners consistently struggle to access capital.

Almost half (46%) of owners express concerns about how a limited credit history adversely affects loan opportunities, according to market research by J.D. Power. Almost two thirds (65%) of SMBs report that inflation is resulting in increased operating costs and unstable pricing strategies, according to the same research. And fully approved loan applicants decreased by 9% between 2019 and 2022, according to the FRB survey.

Corporate cards and somewhat limited access to small-business loans are helping tide things over for now. But when a Mastercard study finds that 55% of US consumers are willing to share secure access to their financial account data in exchange for the potential benefit of obtaining a better loan or interest rate, SMB borrowers will likely share that willingness too.

On the other side, SMB lenders grapple with many challenges when striving to profitably and efficiently meet the needs of their SMB borrowers. One hurdle is a lack of data to accurately assess risk; only slightly better is incomplete data that still cannot support complete assessments. And regardless of credit history, many traditional risk assessment models are designed for the needs of larger rather than smaller businesses.

Open banking offers an alternative by letting financial institutions gain real-time insights into an SMB's transactions and performance. Tailored financial products result.

Transforming SMB lending

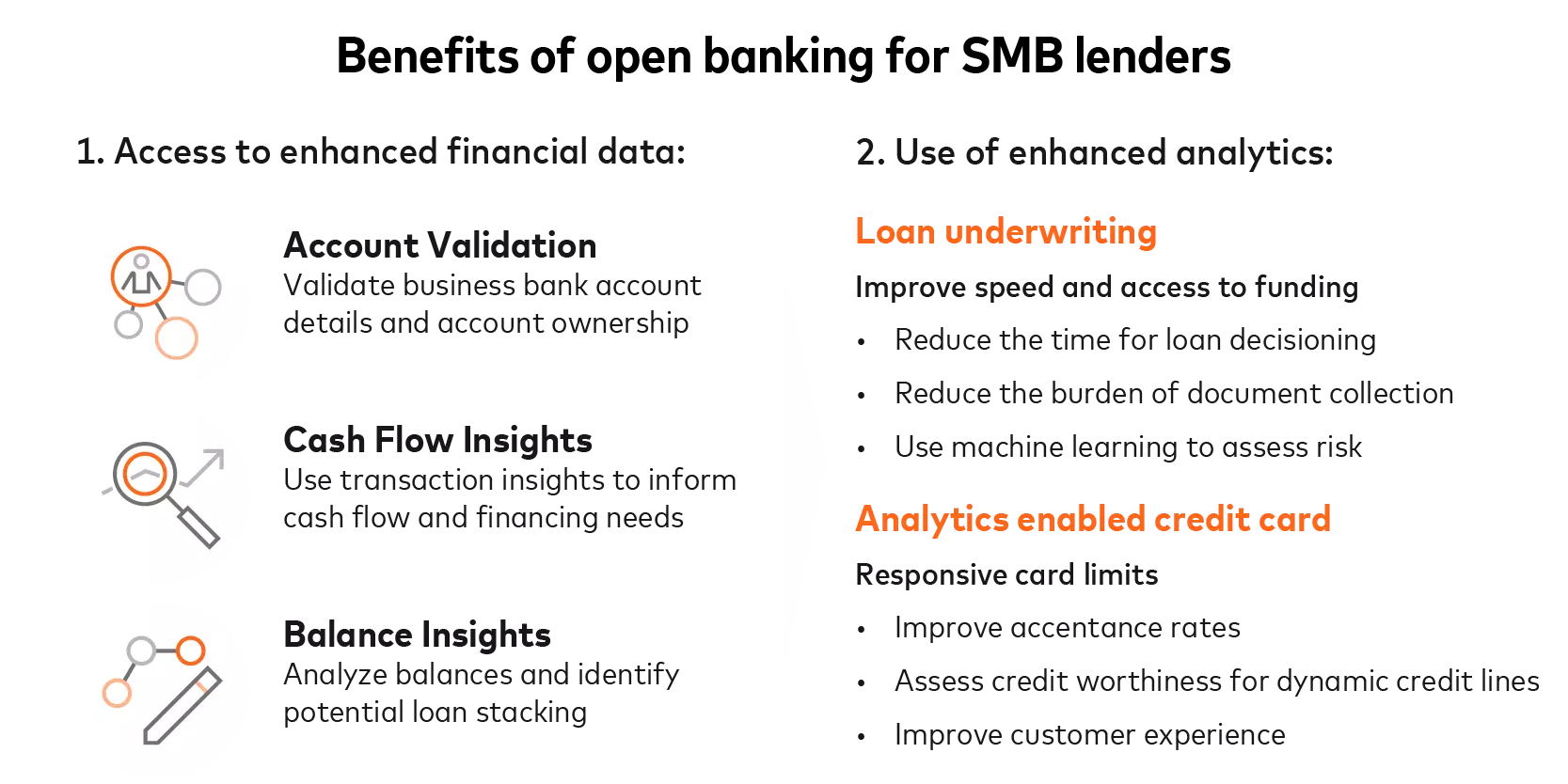

Open banking is revolutionizing financial services from lending to payments, and it is even enabling better financial decisions for all types of audiences such as consumers, SMBs and large corporations. Open banking can be transformative for SMB lenders through enhanced access to SMB-permissioned financial data that sheds light on account transaction data and credit card receipts.

In turn, enhanced access allows enhanced analytics. Detailed SMB-permissioned data on inflows, outflows, non-sufficient funds and account balances allows financial institutions to assess risk more comprehensively. In particular, credit card data unveils a deeper understanding of vendor payment details for predictive analysis of credit risk exposure.

In essence, open banking not only provides more complete financial pictures of borrowers but also empowers lenders to make more informed decisions. Some advantages of open banking for SMB lending include:

- Enhanced risk management by supplementing credit bureau information with SMB-permissioned data on cashflow management and deposit-account balances.

- Confident approvals of loan and card applications from no-file and thin-file customers as well as “on margin” customers that may lack the minimum requirements for a traditional credit score.

- Reduced costs by streamlining document collection and increasing automation for loan underwriting.

- Smoother application processes to reduce customer drop-off rates.

Enhanced data access

Open banking offers an array of cash-flow insights that can enrich lending assessments. These insights encompass a wide range of data, including debit and credit summaries, average transaction values, estimated revenue figures, instances of non-sufficient funds, deposit and withdrawal histories, and net cash-flow calculations. These details of financial operations give lenders a deeper understanding of an SMB’s financial health, cash-flow stability and ability to meet loan obligations.

In addition, open banking can identify possible cases of loan stacking by recognizing new inflows into deposit accounts and new outflows that are designated as payments to financial institutions. This cash-flow data includes parameters such as minimum and maximum cash balances, averages of cash balances, occurrences of negative balances, and the number of days an account maintains a negative balance during a given period.

Such insights help lenders gauge the financial strain a business may be under and overall cash balance health. This proactive approach allows lenders to mitigate risks associated with loan stacking and offer more responsible and sustainable financing solutions.

- Use case

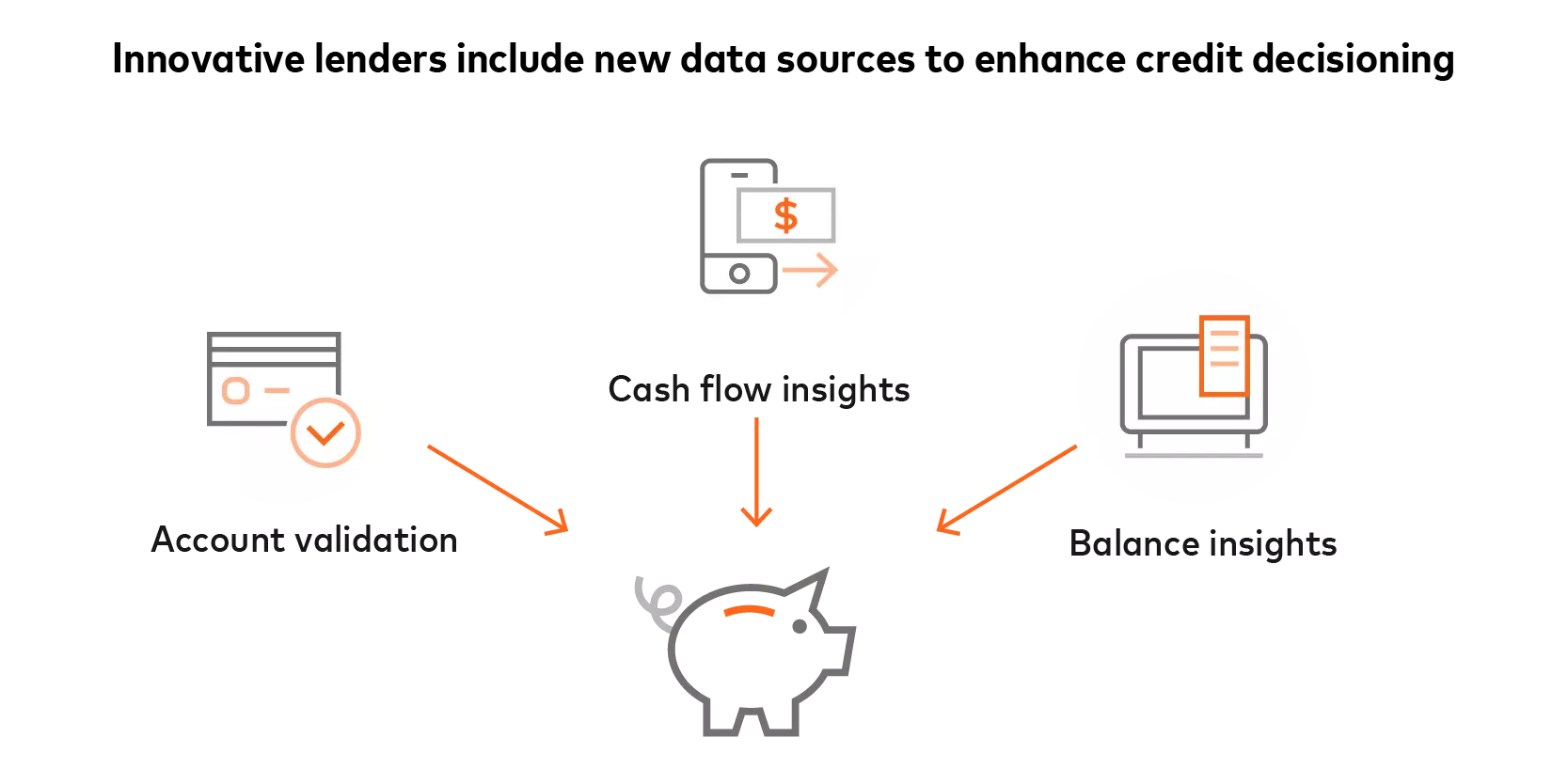

Innovative lenders are including new data sources in traditional credit scoring to give borrowers more comprehensive financial profiles.

Mastercard Open Banking allows lenders to provide SMBs with better access to the capital they need to start, run and grow. Lenders can then broaden the scope of their services to SMBs to help them better serve their consumers. Lenders also benefit in two key ways:

- Better informed decisions for loans and credit products by enhancing assessments of creditworthiness.

- Increased customer engagement by enabling secure data sharing, enhancing transparency, and giving SMBs greater control over their own financial relationships.

Harnessing the capabilities of open banking not only facilitates quicker and more informed decision-making in the lending process but also provides a comprehensive understanding of a business's financial dynamics. The decisioning that goes into loan underwriting is more efficient when lenders can confidently offer responsible and sustainable financing solutions while effectively managing associated risks.

Enhanced analytics

Open banking and machine learning can combine to facilitate loan underwriting by allowing for accurate and data-driven lending decisions. This expedites approvals while also enhancing precision to ultimately benefit borrowers and lenders.

- Case study

Lendio is an online loan marketplace specifically designed for SMB owners. Its loan application process has three simple steps:

Step 1 - Apply in 15 minutes: Business owners benefit from a quick hassle-free application process. Lendio ensures a user-friendly online application with no upfront fees or obligations.

Step 2 - Choose from 75+ lenders: Through a straightforward online application form, business owners effortlessly connect with a diverse array of lending partners.

Step 3 - Access funds fast: Funds become available in as little as 24 hours after approval.

Lendio’s success comes from harnessing the power of open banking to expedite the application process for SMB owners and enhance decision-making for SMB lenders. The integration of Mastercard Open Banking solutions, provided through Finicity, a Mastercard company, allows SMBs to securely share comprehensive transaction data with Lendio's lending partners and fintech companies. Armed with a holistic view of an SMB’s financial health, lenders gain valuable insights into creditworthiness and can make more informed lending decisions.

Beyond traditional loans, open banking also extends into analytics-enabled credit cards.

Credit card issuers can use open banking to offer more responsive credit limits that adjust dynamically based on an SMB's specific financial profile and behavior. The dynamism enhances acceptance rates and allows for regular assessments of cardholder creditworthiness. The result is more reflective of modern financial needs and behavior by creating a more inclusive and user-centric experience.

- Case study

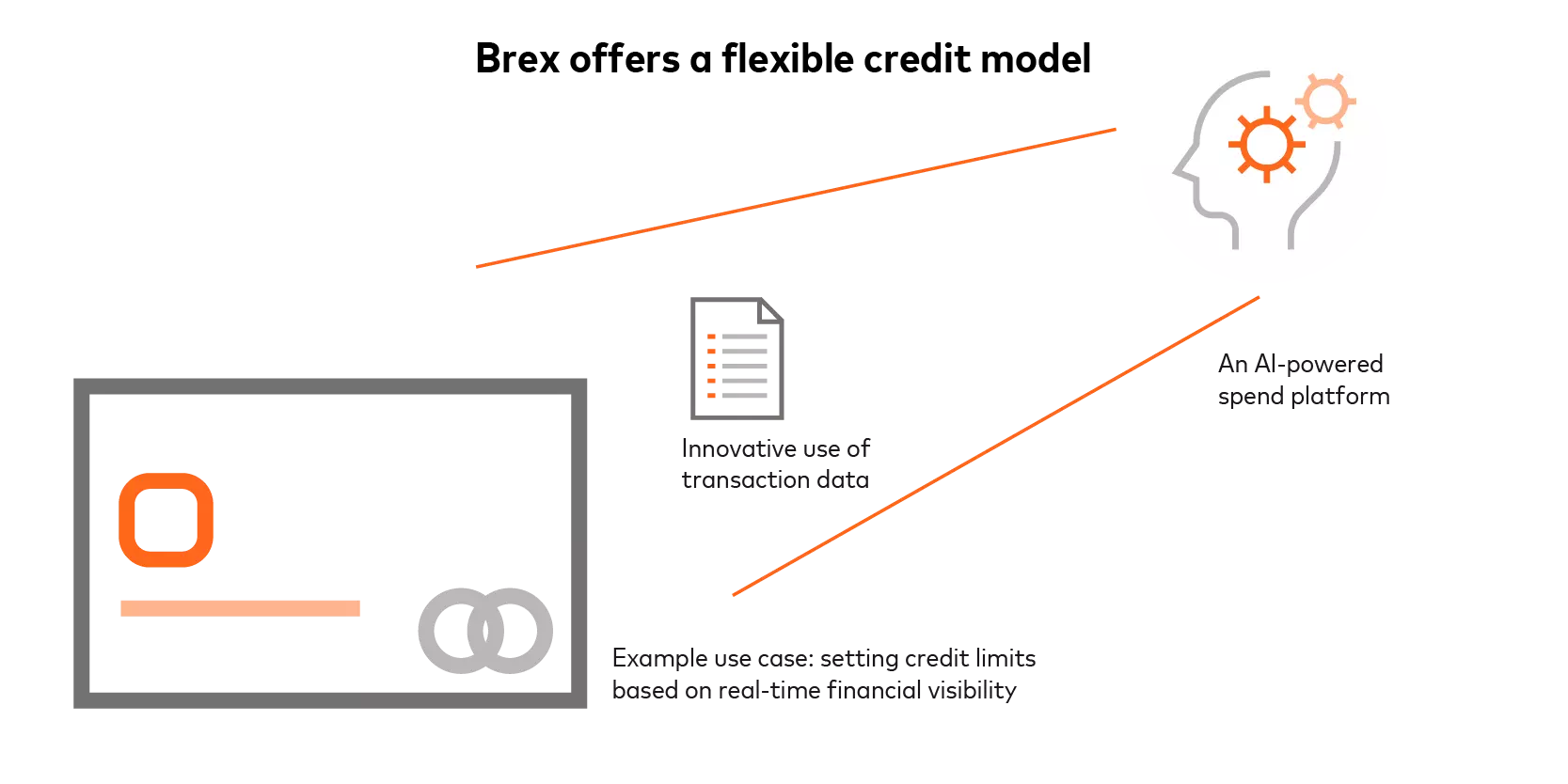

Brex, an AI-powered spend platform, empowers businesses and corporates to spend with confidence through integrated cards, spend management, travel and expense management, and payments in over 100 countries. It also offers a flexible credit model designed to support businesses with limited operating history, revenue or profitability.

What sets Brex apart is its innovative use of transaction data to automate accounting, expense management, and set credit limits based on real-time financial visibility.

Through its use of Mastercard Open Banking provided by Finicity, a Mastercard company, Brex uses customer-permissioned data for real-time financial insights that go beyond traditional metrics to allow for more informed credit decisions.

Open banking is reshaping credit to the benefit of SMBs and the financial institutions that serve them. SMBs benefit from a streamlined application process and solutions tailored to their needs. Financial institutions benefit from improved risk-adjusted revenue through a more comprehensive view of their borrowers.

Implementation roadmap

Clear lending objectives and strategies start with defining and assessing use cases, such as supporting SMBs without established credit histories that have been denied loans in the past. Prototype development, UI/UX testing for seamless experiences, and risk-management integration should be supported by a three-step process:

- Understand the existing lending ecosystem: Review and evaluate the current underwriting process to develop a comprehensive understanding of the factors that lead to supporting and making credit risk decisions.

- Select the right partners: Consider partnering with open banking service providers who can enhance capabilities and expedite implementation by accelerating deployment and delivering customer value across entire customer journeys — from launch to ongoing monitoring.

- Enhance analytics and overall engagement: Use open banking insights to personalize user experiences and engage SMBs with tailored credit products that solidify the customer relationships and lead to higher satisfaction and loyalty.

This three-step process helps unlock the potential of open banking by prioritizing innovation.

Conclusion

Open banking gives businesses control by letting them grant secure access to their financial data for better financial relationships. But it is lending where SMBs will gain through improved access to loans via seamless integrations, streamlined and secure processes, and personalized solutions.

Nowadays, opening an account or applying for a loan online is standard practice and comes with expectations around speed and funding. Know your customer (KYC) checks, external account verification and fraud protection can be part of a single process through secure connections between application programming interfaces (APIs) that enable competitive tailored loans. Moreover, financial institutions can better understand an SMB’s current and projected financial health by linking its accounting software to digital banking solutions, which helps them manage portfolio risk.

Nonetheless, challenges remain: ongoing regulatory evolution, challenges with identity verification, non-standard API connections, and the need for heightened privacy and data security protocols and secure customer authentication.

How can Mastercard help?

Through Finicity, Mastercard Open Banking in the US provides connectivity for the permissioned sharing of data. Lenders can access SMB cashflow insights traditionally not used for underwriting that allow borrowers to access a wider range of services and verify themselves digitally without submitting paper documents.

- Lenders can access real-time account data including transactions and statements from up to 24 months, enabling quick verification of account details.

- Lenders can validate assets, employment and income to make informed decisions in real time.

- Lenders can access clear cash-flow analyses of credits, debits and balances to better understand a borrower’s liquidity and revenue streams.

Mastercard differentiators include:

- Connectivity: The Mastercard open banking platform provides a trusted technology base and best-practice API connectivity that enables innovators to achieve scale, speed and agility while empowering SMBs to benefit from their financial data.

- Responsibility: Mastercard’s data & tech responsibility principles are based on security and privacy, accountability, transparency and control, integrity, innovation and social impact.

- Data quality and accuracy: Finicity is a data aggregator and a registered Consumer Reporting Agency (CRA) that provides consumers with transparency and control in case of a dispute.

- Consulting services: Our consultants support innovation to build and implement robust strategies, prioritize use cases and develop prototypes.

- Trust: We are a global partner with worldwide recognition and operations in more than 210 counties and territories.

Frequently asked questions

How can open banking be used in risk assessment models for small-business lending?

Open banking can be used to enhance risk assessment capabilities through enhanced access to financial data, such as account transaction data (inflows, outflows, non-sufficient funds, and account balances) and credit card data. Rather than relying solely on historical financials or physical assets as collateral, financial institutions can now use data analytics and non-traditional credit scoring models or metrics to offer credit products tailored to the risk profile and business potential of SMBs.

How seamlessly can open banking APIs be integrated into existing lending systems?

API access may be direct, partner linked or via embedded resellers:

- Direct access: Financial institutions can connect to Mastercard and receive open banking solutions directly.

- Partner-linked access: Financial Institutions can connect to Mastercard and then use a Mastercard-supplied access token, or “key,” to share with a third-party partner, such as a payment processor, for data access.

- Access via an embedded reseller: A reseller can include Mastercard APIs with their software development kits (SDKs) to provide to financial institutions.

How do banks get consent from SMB owners to access their financial data?

Typically, banks obtain consent from SMB owners during the standard application process. Banks can use consent management tools, such as Mastercard Connect, to enable their customers to permission access to their bank account data. With Connect, customers can select their bank accounts and grant access to relevant data.

How do open banking providers maintain the security of sensitive financial data being shared through APIs?

Financial institutions can partner with established and trusted financial service providers that tokenize data to avoid leaks of personally identifiable information (PII). All providers must always receive permission from individuals to store, share, and gain access to their data, complying with data protection and privacy safeguards.

Meanwhile, the Financial Data Exchange (FDX) is refining industry standards for direct-access APIs, which allow data to be connected seamlessly, securely, and in real-time between financial institutions and third parties.

- Report contributors:

Abhishek Roy, Aishwarya Aishwarya, Franciso Bustillos, Ritika Tiwari