Maximize your portfolio potential

Mastercard Portfolio Optimizer 2.0 is a dynamic, self-service web application that helps issuing banks identify ways to increase spending and curate audiences for highly personalized marketing campaigns. With Portfolio Optimizer 2.0, issuers can promote travel and cross-border spending, engage low performing and dormant cards, and retain top-of-wallet cards. Mastercard’s cutting edge AI and analytics capabilities are available at your fingertips through an intuitive web interface, helping you capitalize on fresh data to accelerate the launch of marketing campaigns.

Request a demo

Let one of our specialists show you how Mastercard Data & Services can enhance your

business performance, elevate consumer experiences and enable innovation.

Design, execute and measure your marketing program

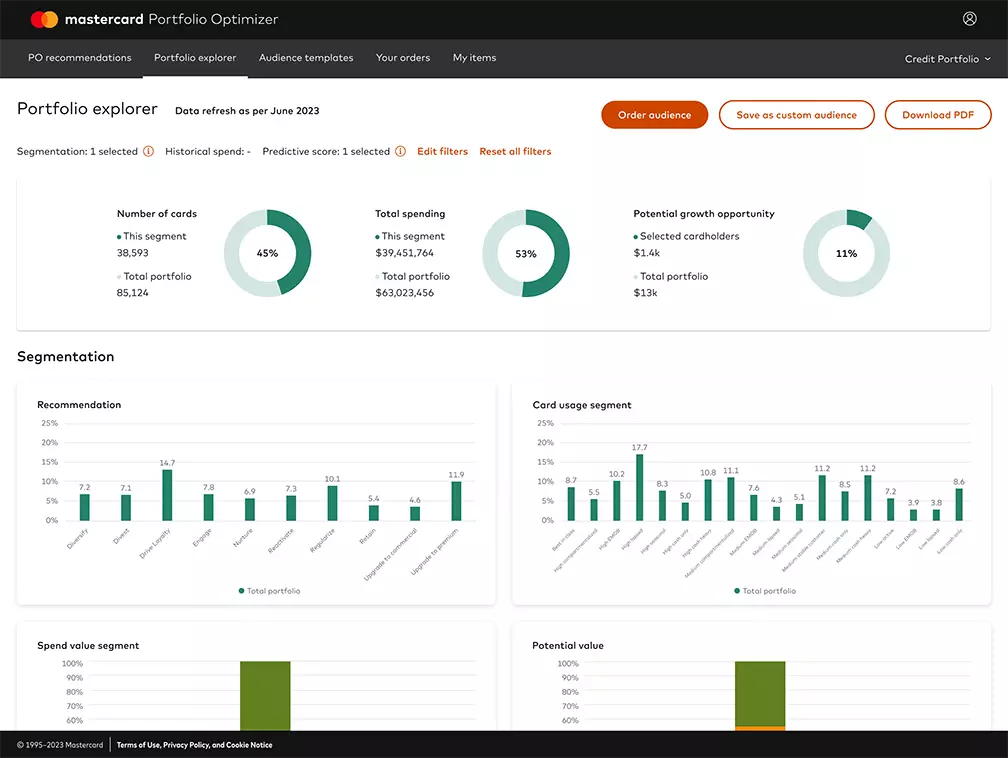

Analyze your current portfolio

Drill into cardholder’s data through a rich data cube and identify growth opportunities.

Identify portfolio strengths and weaknesses through dynamic data visualizations.

Dive into spend metrics to gather insights about historical activity.

Leverage propensity models to predict your cardholders’ future spending behavior.

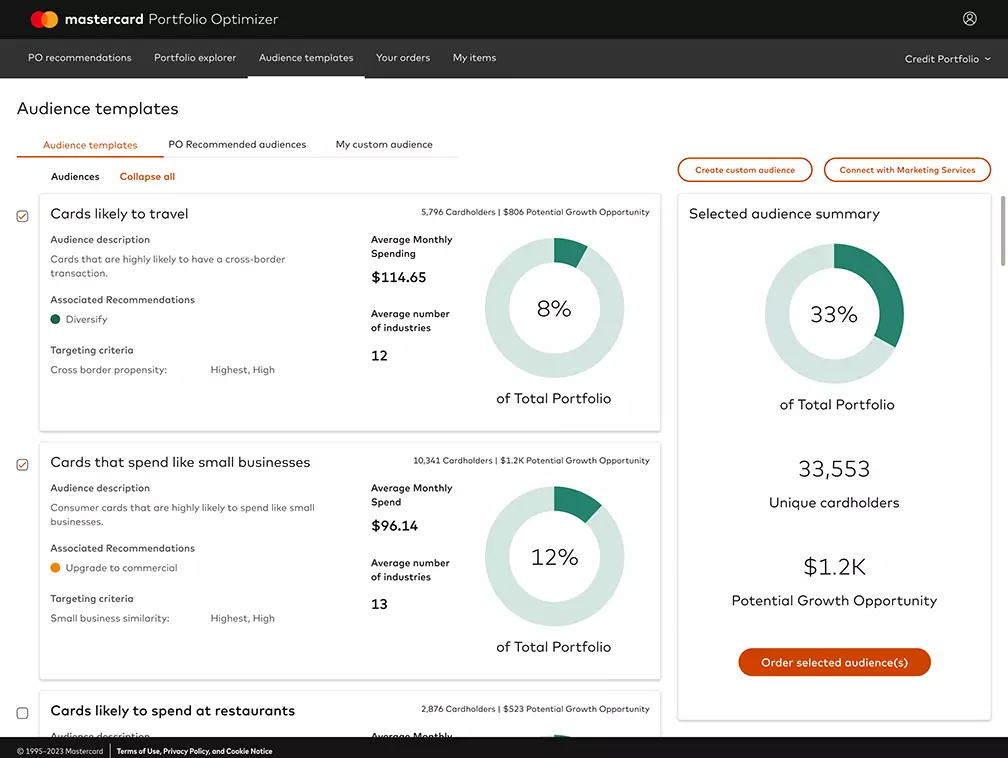

Identify and understand the right audience

Tap into a robust library of audiences to execute more engaging marketing campaigns.

Choose from a library of audiences powered by marketing services.

Customize your own audience based on your own targeting criteria.

Order lists of audiences based on Primary Account Number to enhance your marketing strategy.

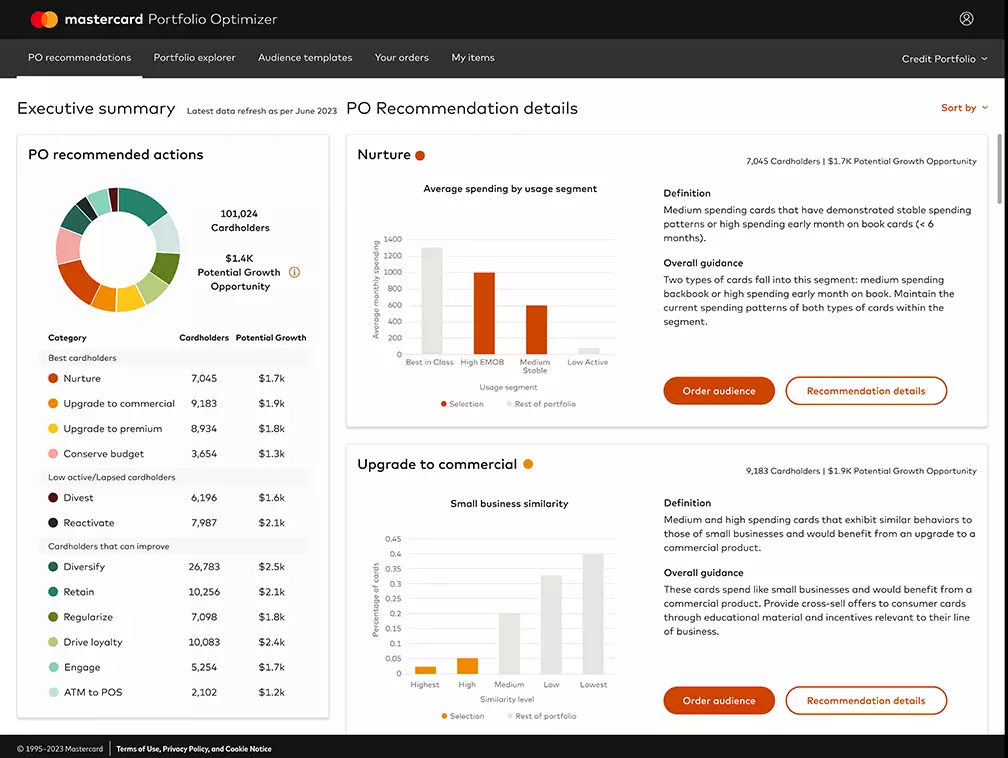

Action on prioritized recommendations

Review a summary of prioritized recommendations for your portfolio.

Quantify growth opportunities within the portfolio to guide your marketing strategy.

Tap into summarized recommended strategies curated by industry experts.

Identify the next best action.

Mastercard Consulting

Partner with our experts to determine opportunities for portfolio strategy optimization.

Invest in proactive and continuous portfolio management

A large Asian bank wanted to improve portfolio performance by increasing cardholder spend activity, but new market regulations required it to terminate cards that had been inactive for 18+ months. Given this new regulation, the bank focused on reactivating inactive cards.

Mastercard Advisors segmented inactive cards using Portfolio Optimizer and Mastercard's anonymized and aggregated transaction data. Portfolio Optimizer identified high-value accounts that had been inactive for a short time and were likely to reactivate and achieve certain amounts of spend.

The bank launched campaigns to reach this segment, resulting in a high 48% reactivation rate for the test group vs. 33% for the control group, a 5% increase in spend on inactive cards, and a 10% lift in average test group spend one month post-campaign.