By: Daniel Varkonyi, Alejandro Brito, Karan Tyagi, Pranav Shukla and Shreya Goel

Published: May 20, 2024 | Updated: November 20, 2024

Read time: 10 minutes

The axiom of doing one thing well wasn’t coined with the commoditization of payment acceptance in mind. When helping medium-sized and big businesses accept payments, capable execution is largely an expectation rather than a point of differentiation.

Not so for the more diminutive end of micro, small & medium-sized enterprises (MSMEs). Micro businesses in particular have sometimes been overlooked by acquiring banks. They were too small to make traditional solutions pay off, point-of-sale terminals and e-commerce integrations were expensive, onboarding processes were lengthy, and treasury management was a challenge.

The digitization and democratization of digital payments has changed that narrative as other payment service providers (PSPs) acting as fintech acquirers have joined the ranks of acquiring banks. Businesses with fewer than 250 employees accounted for 70% of global merchant acquiring revenue in 2022, according to the consultancy BCG.

But in the end, support of micro and small businesses runs the same risk of commoditization as support of medium-sized and big businesses. To stave off commoditization in their roles as PSPs, acquirers are recognizing the importance alongside traditional payment services of value-added services (VAS) that are tailored to micro and small businesses.

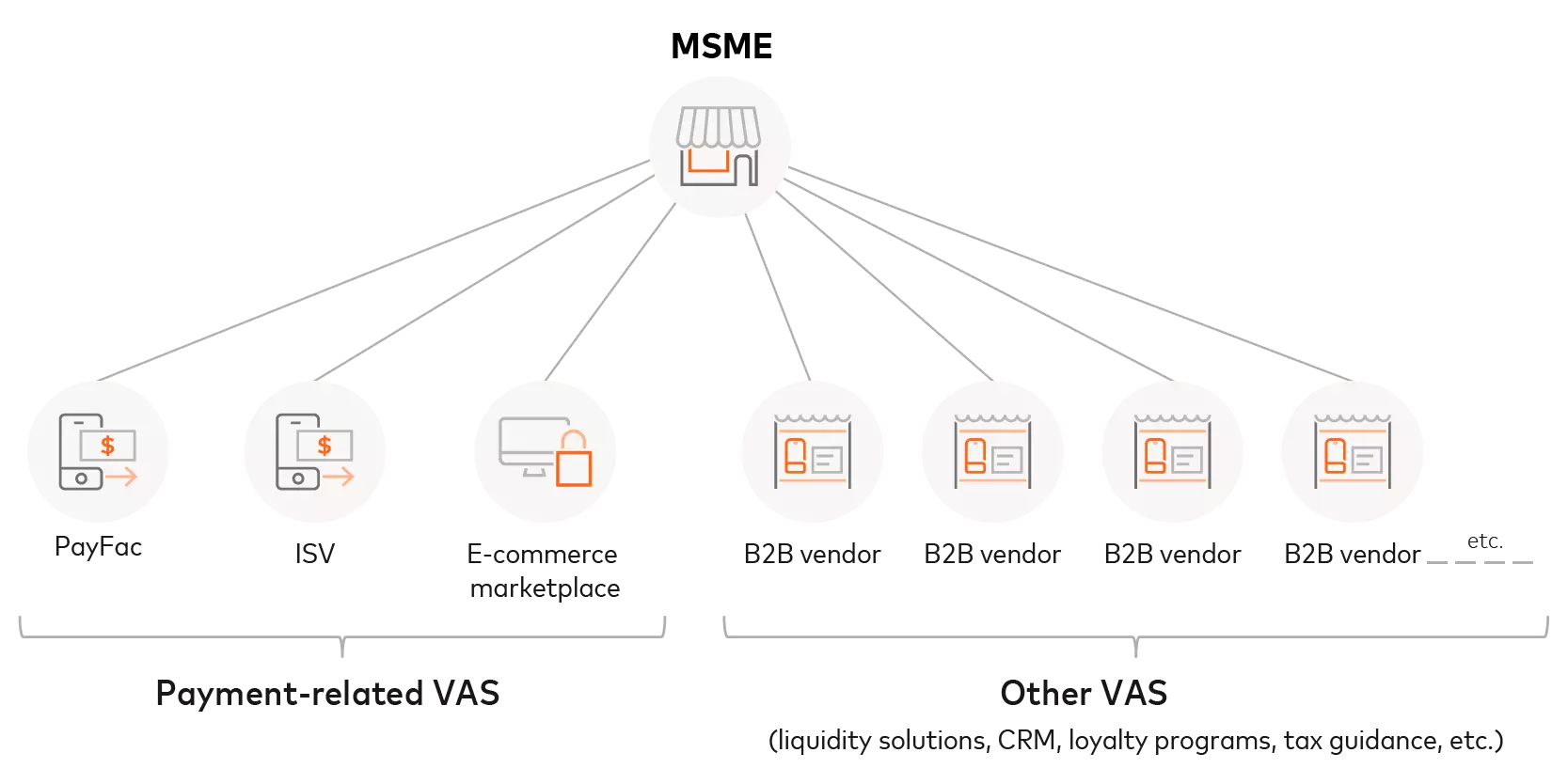

The prominence of payment facilitators (PayFacs), independent software vendors (ISVs), and e-commerce marketplaces is behind much of this evolution.

- Explore more

From backup singing to lead vocals: Payment acceptance moves to the forefront of payment technology

Cardholder or card not present as physical and digital payments blur

The PayFac, the ISV, and the e-commerce marketplace

In a competitive market with ever tightening margins, acquirers often enlist independent sales organizations to help find customers and then assign them a merchant ID for payment processing.

An alternative approach comes from PayFacs, who simplify matters for MSMEs who do not have the particular processing predilections of big businesses. They group MSMEs together under one ID for rapid onboarding and relatively hands-off management. Over 5,000 fintech companies, including many PayFacs, now operate in the payments space and account for close to $100 billion of total global revenues, according to the BCG report.

At the same time, a blurring of physical and digital payments is occurring as alternative payment methods proliferate, such as tap to pay for mobile wallets operating like contactless cards, scan to pay for QR code payments, and Click to Pay for e-commerce. ISVs now provide much of that technology while also providing lean and simple onboarding processes commensurate with those offered by PayFacs and sometimes in partnership with them or with acquiring banks. These partnerships may allow segment-specific technology without expensive integrations, such as wireless ordering on a cash register installed on a restaurant’s mobile device.

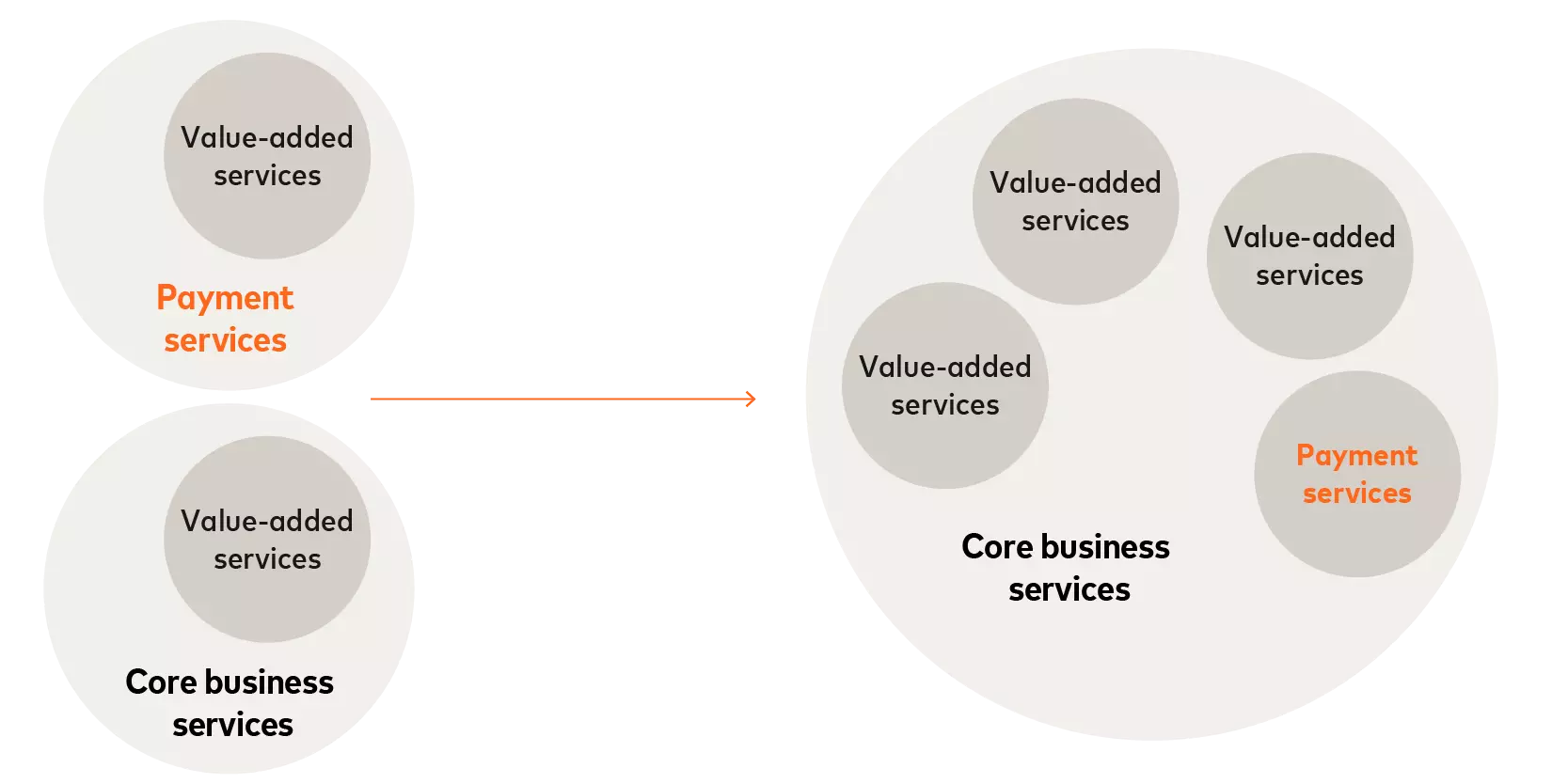

Beyond more obvious acquirers, e-commerce marketplaces are now offering integrated payment solutions for sellers on their platforms through embedded finance to simplify payment acceptance and settlement. In a world where any business can theoretically “turn fintech,” payments themselves are in some ways becoming a value-added service on top of the core services supporting a merchant’s business.

This inversion of the traditional approach to acquiring underscores the growing importance of tailored VAS solutions to merchants.

The attractiveness of value-added services to micro and small businesses

As core payment-enabling services continue to commoditize, the opportunity to deliver enhanced VAS to micro and small businesses continues to grow. Businesses with less than $10 million in revenue are willing to spend an annual total of $10,000 on VAS and already 70% of them use one such service from a PSP, according to a 2022 survey by the consultancy McKinsey.

Whether traditional acquirer or fintech acquirer, many PSPs are now offering a range of merchant solutions that extend beyond acquiring. Some solutions simplify and streamline activities around payment acceptance: quick and simplified onboarding, software point-of-sale (softPOS) solutions for mobile devices, overnight shipping of physical hardware, simpler pricing and consistent rates for all payment and rewards cards, quick and sometimes even instant bank deposits, fraud protection, and multi-currency processing.

But the most transformative VAS come from further afield in areas where micro and small businesses have often been priced out or where solutions have been infeasible without expensive investments elsewhere. They include loyalty and rewards programs, analytics for understanding customer behavior, e-commerce tools, acceptance of electronic benefit transfers, data analytics and reporting, working-capital loans based on transaction data, business banking, payroll services, and cash flow management.

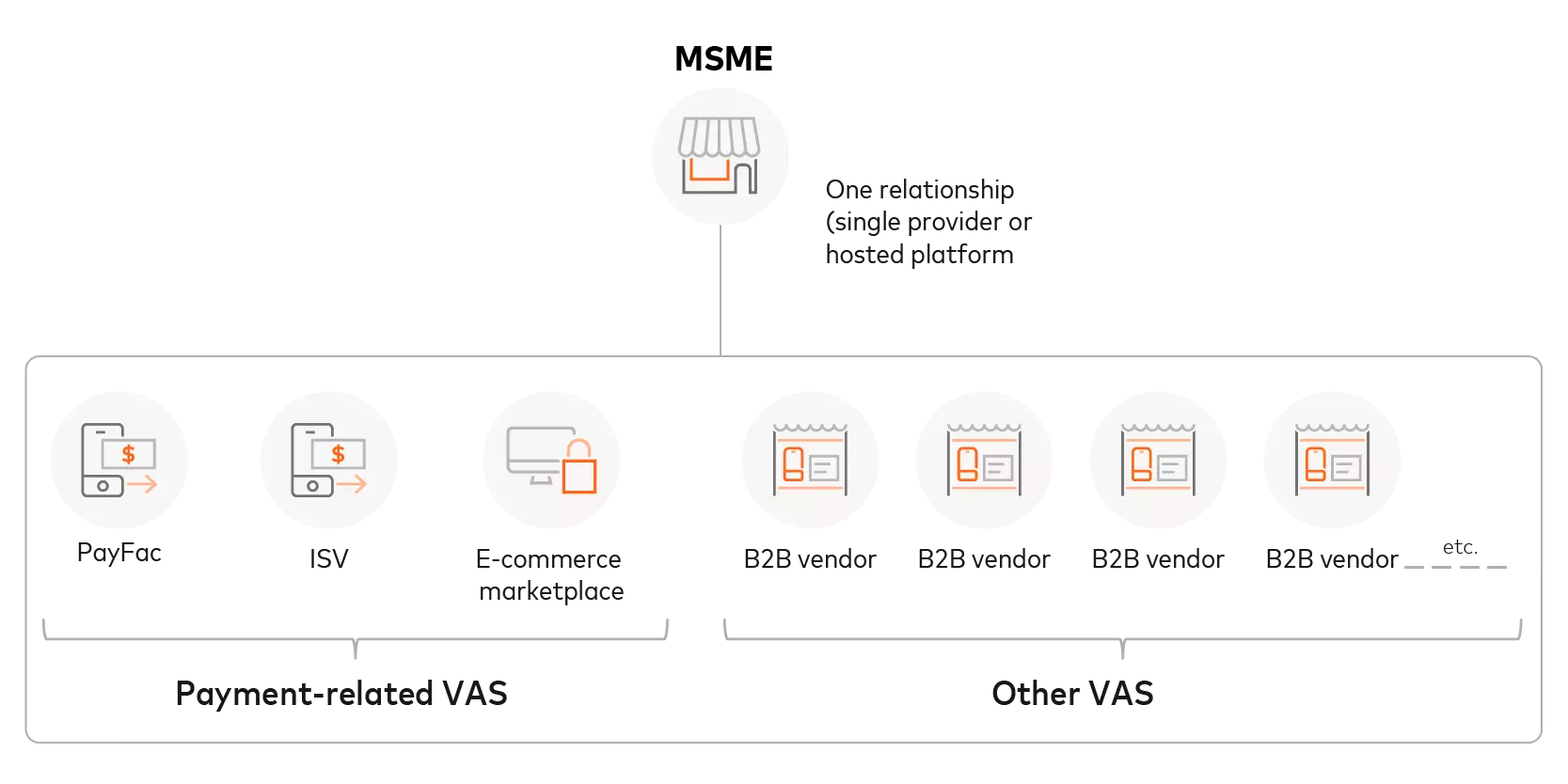

Several acquirers are also creating integrated ecosystems for MSMEs through strategic partnerships and technology integrations. The approach allows MSMEs to manage multiple aspects of their business on a single platform that simplifies operations and reduces the need to juggle between providers. Services may include combining invoicing with payments, integrating accounting apps, appointment scheduling, marketing services, customer relationship management (CRM) at the POS, sales and inventory tracking, and tax preparation.

Conclusion: From cost to convenience

MSMEs consider a host of factors when choosing their acquiring partner, according to merchant interviews conducted by Mastercard in 2022. Often, they want a partner to help them expand and sharpen their business. Primary considerations are fees, user-friendliness and reliability, along with customizability and easy integration with existing systems.

Perhaps most significantly, MSMEs are often ready to pay extra for additional integrations and platforms as long as it helps them grow their businesses. They appreciate the convenience of being able to manage everything in one place. Something that saves a tightly run business time and money should appeal to MSMEs — particularly to micro and small ones.

But appeal can mean little without awareness. To many micro and small businesses, a separate payment provider may be perceived as a cost item. But by adding VAS to a payment acquisition core or by treating payments as VAS on top of core business solutions, a PSP may be perceived as an invaluable benefit rather than a cost.

In the end, there will always be a need for acquiring services. But the key to fully supporting micro and small businesses will lie beyond payments in complete ecosystems that support a variety of business needs at all price points.

Contact us to learn more about our payment acceptance, payment facilitator accelerator and MSME solutions.